New ways to visualize possible outcomes with our all-new Gann Fans drawing tool. Now, clients can click on the “tag” icon at the top right of the Live News gadget, start typing and watch the magic happen.

New thinkorswim enhancements introduced in the second half of 2022 include:Įasier search with predictive text in the Live News Search entry. “In addition to our focus on all of the necessary backend work to keep things running smoothly for clients throughout the integration, these latest enhancements to the thinkorswim product suite are a reflection of our commitment to deliver new functionality that traders want.” “We are working diligently to ensure a successful transition for TD Ameritrade clients moving to Schwab, while at the same time delivering innovation that ensures the best possible trading experience on thinkorswim,” said Barry Metzger, Head of Trading and Education, Charles Schwab. The thinkorswim platform will move to Schwab later in 2023. In August 2020, after announcing its acquisition of TD Ameritrade, Charles Schwab announced plans to adopt thinkorswim and integrate its trading platforms, education resources, and tools into its own trader offering.

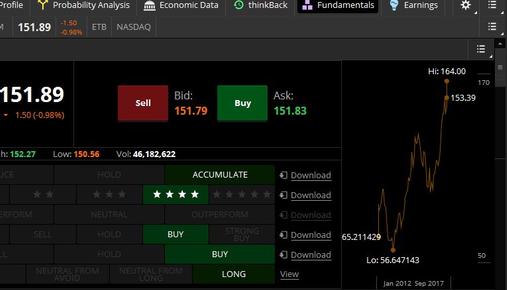

Traders using thinkorswim now have a range of new features and tools available to them to make their trading experience more informed, streamlined, and up-to-date, whether they trade on mobile, desktop, or web. Merrill Lynch advised TD Ameritrade, while Paragon Capital Partners advised thinkorswim and UBS advised thinkorswim’s board.OMAHA, Neb.-( BUSINESS WIRE)-TD Ameritrade continues to release enhancements to its award-winning i thinkorswim trading product suite with a host of new features and services added in the second half of 2022 as TD Ameritrade’s integration with Schwab continues to move forward.

Thinkorswim’s chairman and chief executive, Lee Barba, will stay through the transition, while co-founders Tom Sosnoff and Scott Sheridan will join TD Ameritrade. 398 TD Ameritrade shares for each thinkorswim share. After the deal’s closing, in the next six months, TD Ameritrade will start a buyback of 28 million shares.Īs part of the deal, TD Ameritrade will pay about $225 million in cash and issue 28 million new shares to thinkorswim shareholders, which amounts to $3.34 in cash and. The company has about 87,000 funded retail brokerage accounts and $3 billion

Thinkorswim earned $87 million in pretax income on $380 million in revenue for the 12 months ending Sept. The deal will bring together TD Ameritrade, whose focus historically has been on stock trading, with thinkorswim, a smaller competitor but one that focuses on options trading. TD Ameritrade said Thursday that it was buying thinkorswim for about $606 million in cash and stock, solidifying TD Ameritrade’s standing as one of the largest online brokerage

0 kommentar(er)

0 kommentar(er)